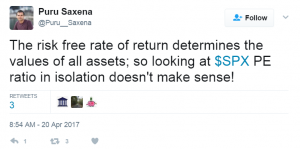

“The risk free rate of return determines the values of all assets…” Every once in a while someone makes a comment which is quite intelligent, and then follows it up with something equally silly. That is the case with this statement.

I absolutely agree with this tweet. However, there are issues with the rest of the discussion. The author does not care about GDP. The author does not think that the risk free rate of return (RFRR) impacts GDP. This is quite odd. Consider the definition of asset provided by Investopedia:

An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit.

If everything of economic value is impacted by the RFRR, then clearly GDP would be impacted. That is exactly why we have to take into account inflation when we look at GDP growth. Economic growth, as measured by nominal GDP, is really not meaningful. Only real GDP growth is meaningful. Now, I do not like the PE ratio either. I prefer to look at net market capitalization to GDP. Again, since RFRR does result in a change in both, as increased earnings are driven up or down by changes in asset values, and GDP is driven up or down by changes in asset values, total market capitalization to GDP is a reasonable way to determining whether or not the market is overvalued.

I have addressed total market capitalization to GDP in a few different articles. In Market Sentiment Vs. Reality I pointed out that it would take years for GDP to catch up to market capitalization, even with no further increase in the price of stocks. So even taking into account the RFRR, stocks are, with little doubt, quite overvalued. Things look worse when taking into account that the current estimate for GDP growth, at least by the Atlanta Fed, is hovering at around 0.5% for Q1.

To be fair, GDP is impacted by more than just corporate earnings. The amount of government spending, for instance, is another factor. So for long term comparisons, variations in non corporate expenditures need to be considered, but it should not be unreasonable to compare the current market capitalization to GDP to what it was leading up to the great recession, or even the dot com bubble.

Further Reading

- Market Sentiment vs Reality II