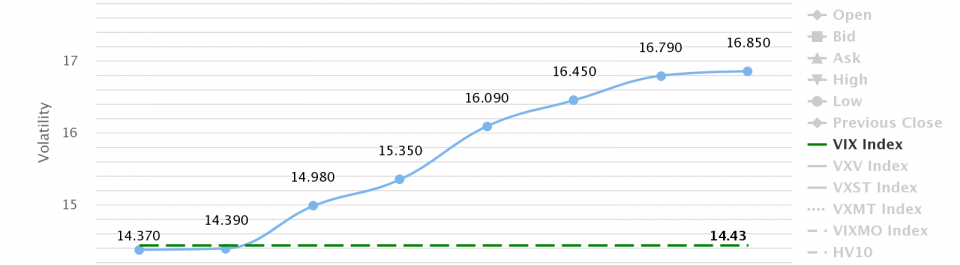

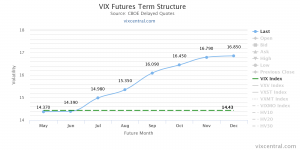

The VIX futures curve (F1-F2) was in backwardation unitl the April contract expired on the 18th. However, backwardation has continued to try to creep into the futures curve, and the current F1-F2 terms have already found themselves in backwardation, although not consistently.

Again, this does not mean pile money into VIXY, but it does raise concerns for people who have been expecting to be able to continue to profit off of XIV.