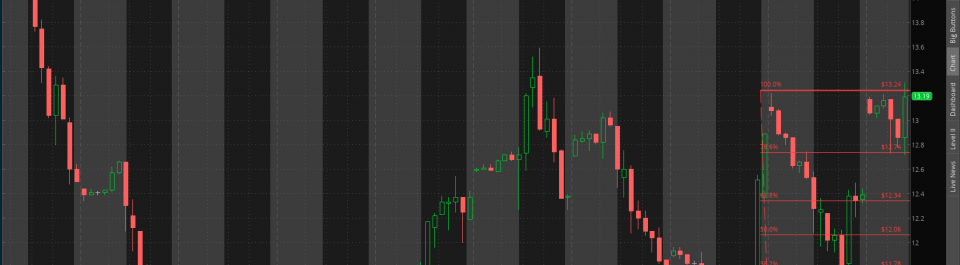

While I do not use Fibonacci retracement and extensions very much, drawing a retracement study from the most recent high to the most recent low, it is clear that the index has spent a lot of time around a few price levels: 11.79, 12.34, and 13.24. If the VIX breaks above this level, we could see a movement to the 161.6% level which would place the VIX at 14.70. This would place the VIX above its 50, 100, and 200 day moving averages.